Tax Legislation Changes

Free Tax Relief Consultation

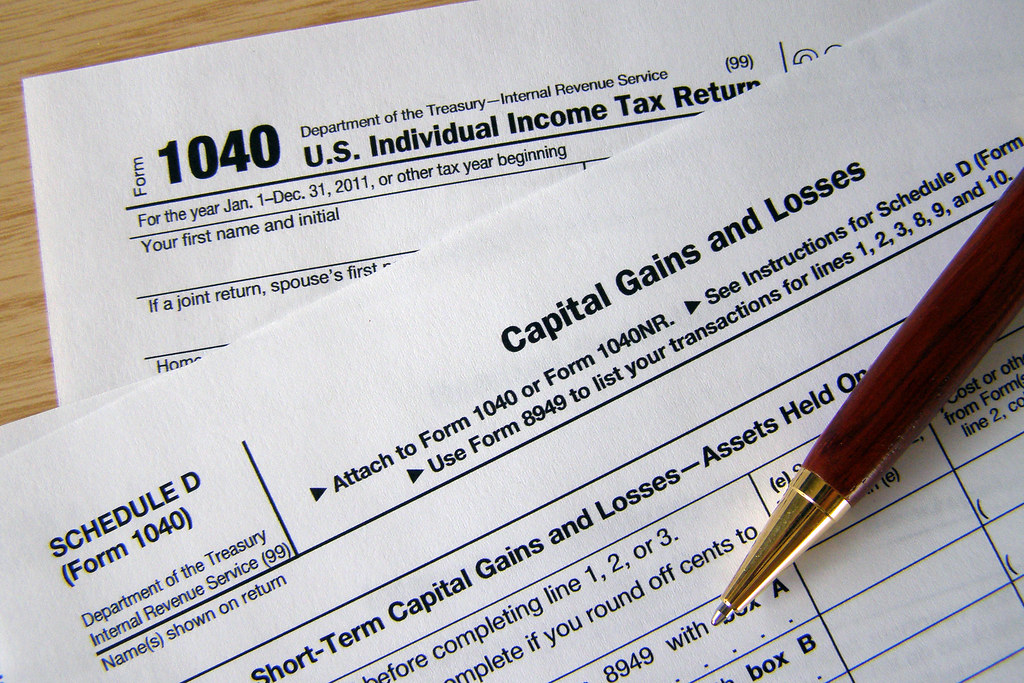

We are within the means of adjusting 2020 Minnesota tax returns affected by legislation modifications to the therapy of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness. For details, learn our September 9 announcement about UI and PPP tax refunds. Revenue AnalysesResearch estimates of how state House and Senate payments may affect revenues and the Minnesota tax system.

For this data, the variance of GDP per capita with purchasing energy parity is explained in 20% by social contributions revenue. Taxes cause a substitution impact when taxation causes a substitution between taxed goods and untaxed goods. Taxes trigger an revenue effect because they scale back purchasing power to taxpayers. If you’ve adjustments to tax returns for 2017, 2018, or 2019 due to the regulation changes enacted in July, you should file an amended return utilizing our updated forms.

Its greater than 10,000 alumni are leaders in major law and accounting corporations, government, the judiciary, academia, and large companies worldwide. Full-time legal professionals who pursue the LLM in Taxation on a part-time basis typically complete the requirements in two to a few years. For added flexibility, you could decide to take fewer credits in a given semester or integrate up to 12 credits of on-line classes into your general curriculum. The half-time Executive LLM in Taxation, which may be completed completely on-line, presents even more flexibility. In both applications, some college students decide to take a few credit of our summer season tax courses … Read More