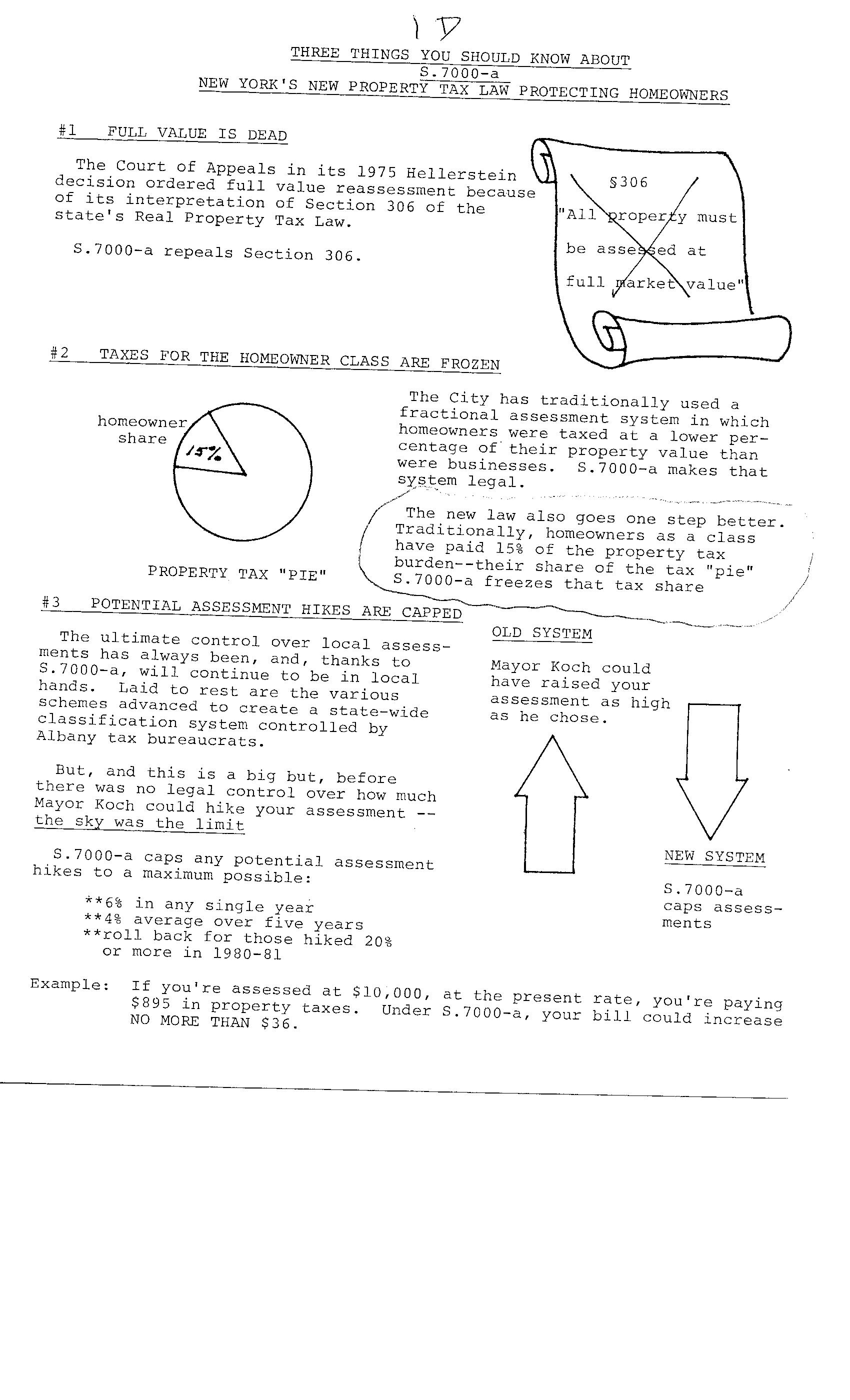

World Specialists Debate Landmark Indian Ruling On Software Taxation

The first recognized taxation happened in Ancient Egypt around 3000–2800 BC. Individuals and firms depend on the experience of tax legal professionals to help them navigate a fancy system of federal, state and local taxes. For lawyers who can master tax law and help their clients apply it, they can have a thriving practice within the field of tax legislation. Lawyers with a background in accounting or finance are especially qualified to practice tax legislation.

Income Tax At Present

She has expertise in advising worldwide shoppers as to their federal tax obligations in Mexico together with everlasting establishment standing, tax methods, expatriate compensations plans and tax controversies. In non-public follow, he has efficiently represented shoppers in all phases of a federal tax dispute, including IRS audits, appeals, litigation, and collection matters. He additionally has vital expertise representing clients in employment tax audits, voluntary disclosures, FBAR penalties and litigation, trust fund penalties, penalty abatement and waiver requests, and felony tax issues. As Chief of IRS-CI from 2017 to 2020, Mr. Fort led the sixth largest U.S. legislation enforcement company, managing a budget of over $625 million and a worldwide workers of approximately 3,000, including 2,a hundred particular agents in 21 IRS area offices and 11 international nations. Mr. Fort modernized IRS-CI by developing chopping-edge, data-centric methods of detecting criminal non-compliance via algorithms and other models. Mr. Fort also significantly expanded IRS-CI’s capabilities in cyber-crime and cryptocurrency investigations, and expanded the company’s worldwide … Read More